Why Tariffs Matter in Global Trade

Tariffs are no longer just economic tools—they are reshaping the structure of global manufacturing, investment flows, and the future of trade. As the U.S., China, and other major economies adjust their tariff strategies, countries like Cambodia find themselves at the center of new global opportunities.

Key Point: Tariffs create both challenges and strategic openings for emerging markets.

Global Tariff Updates (As of May 2025)

U.S. Tariff Baseline: 10% general tariff on all imports.

Cambodia: Tariff Negotiation Status (Updated May 2025)

· Initial U.S. Tariff Imposition:

On April 9, 2025, the U.S. announced a 49% tariff on Cambodian imports.

· Cambodia’s Initial Response:

On April 4, Prime Minister Hun Manet sent a formal request to delay implementation and proposed lowering Cambodia’s own tariffs on 19 U.S. product categories from 35% to 5% as a goodwill gesture.Source: Cambodianess

· Suspension & Negotiation Period:

The U.S. temporarily suspended the 49% tariff for 90 days, applying a 10% baseline tariff while formal talks continue.Source: Cambodianess

· Recent Development – Solar Panel Case:

On April 22, the U.S. announced an astonishing 3,403.96% tariff on Cambodian solar panels and cells, citing “country-of-origin laundering” through Cambodia.[Source: Phnom Penh Post]

· Cambodia’s Official Reaction:

On May 1, Prime Minister Hun Manet publicly committed to implementing strict rules of origin compliance to crack down on manufacturing transshipment and origin fraud.[Source: Khmer Times]

· Cambodia-U.S. Tariff Negotiations to Be Held in Washington on May 14 :

On May 14, Cambodia and the U.S. government will hold their first formal negotiations on bilateral trade issues in Washington. On May 2, Cambodian officials held a second preparatory video conference with the U.S. side. In response to U.S. concerns, Cambodia announced new regulations on May 1 to strengthen the management of the origin of goods exported to the U.S., which will take effect on May 12.

· Cambodia and the U.S. Conclude First Round of Trade Talks:

Cambodia and the United States held the first round of reciprocal trade agreement negotiations in Washington from May 13 to 15, engaging in in-depth discussions on the draft agreement. Both sides agreed to hold the second round of negotiations in Washington during the first week of June 2025.

Vietnam: Tariff Negotiation Status

· Initial U.S. Tariff Imposition: The U.S. announced a 46% tariff on Vietnamese imports, citing trade imbalances. Modern Diplomacy

· Vietnam’s Response: Vietnam offered to reduce its tariffs on U.S. goods to 0% in exchange for the U.S. reconsidering its tariff decision. The Economic Times / The Guardian

· U.S. Reaction: The U.S. administration, through trade adviser Peter Navarro, rejected Vietnam’s offer, stating that addressing non-tariff barriers and trade practices was also essential. Barron’s / New York Post

· Current Status: The 46% tariff has been temporarily paused until July to allow for further negotiations, with a 10% baseline tariff in effect during this period. Reuters

· First Round of Vietnam-U.S. Tariff Negotiations to Be Held on May 7 :

On the morning of May 5, during the ninth session of the 15th National Assembly of Vietnam, Prime Minister Phạm Minh Chính revealed that the first round of negotiations between Vietnam and the United States on new tariff policies will take place on May 7.

China’s Retaliatory Measures

· Tariffs on U.S. Goods: China has imposed a 125% tariff on American imports in response to U.S. tariffs. AP News + Business Insider

· Exemptions: Certain U.S. semiconductors have been exempted from these tariffs, indicating a selective approach. New York Post

· China has decided to engage with the U.S.:Based on full consideration of global expectations, China’s own interests, and the appeals from U.S. industries and consumers, China has decided to agree to engage with the U.S. side.

· China and the U.S. Each Cancel 91% of Tariffs:On May 12, China and the United States issued a joint statement, pledging to simultaneously and significantly eliminate 91% of tariffs. For the remaining tariffs, both sides will adopt phased easing measures (suspending 24% for 90 days), retaining only 10% of the tariffs.

Manufacturing Shift: Why Southeast Asia is the Future

Trend: Global manufacturing continues to shift from China to Southeast Asia due to:

· Rising labor costs in China

· Geopolitical tensions (esp. U.S.-China)

· New tariffs on Chinese exports

Top Industries Moving to Cambodia:

· Textiles and Garments

· Footwear and Leather Goods

· Agricultural Processing

· Basic Electronics Assembly

· Industrial Parts and Logistics Services

Cambodia’s Specific Manufacturing Opportunities (2025–2030)

Key Insight: Cambodia will first dominate in labor-intensive, low-mid complexity industries and agro-processing, while gradually moving into light industrial components over the next decade.

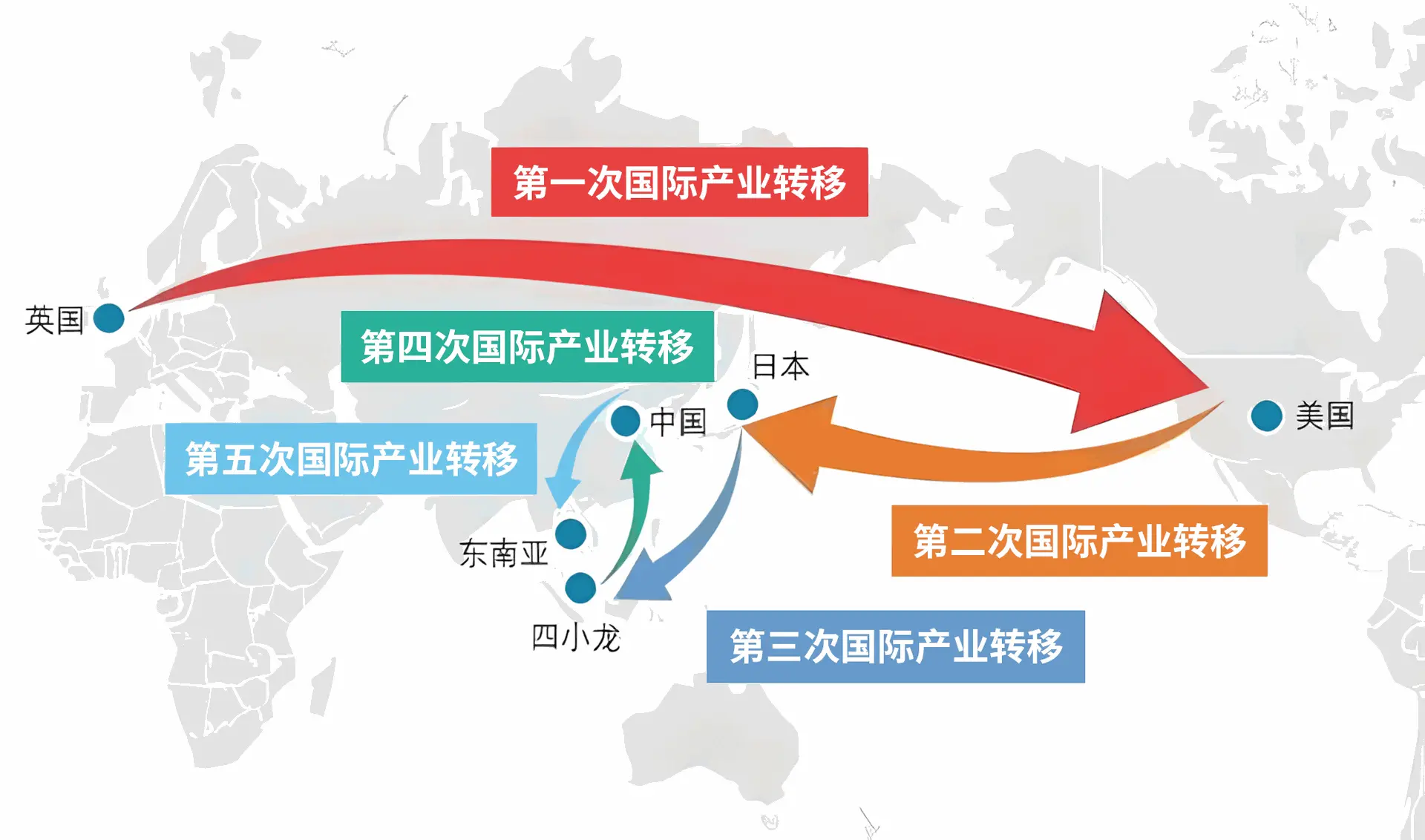

Manufacturing Migration Pipeline: The Five Global Waves

UK → USA → Japan → Four Asian Tigers → China → Southeast Asia (Next Wave)

The Five Global Shifts of Industrial Migration

· UK → USA

The Industrial Revolution drove manufacturing leadership from Europe to North America.

· USA → Japan

Post-WWII reconstruction and innovation fueled Japan’s rise as an export powerhouse.

· Japan → Four Dragons

In the 1970s, outsourcing and OEM manufacturing models took root in South Korea, Taiwan, Singapore, and Hong Kong.

· Four Dragons → China

China’s Reform & Opening policies in the 1980s–90s established it as the world’s factory.

· China → Southeast Asia (Today)

Rising costs and geopolitical tensions are accelerating the shift to ASEAN nations.

Insight: Each wave followed a combination of cost efficiency, political stability, and supply chain evolution. Southeast Asia is now entering its own era of opportunity.

Manufacturing is steadily flowing southward, following cost and supply chain restructuring trends.

Gold Price Surge and Implications

Recent Development:

· Gold prices surged to over $3,400/oz in early 2025 before slight corrections.

· Massive central bank buying (esp. China, India, Turkey).

Global Gold Reserve Rankings (2025)

1. U.S. (8,133 tonnes)

2. Germany (3,352 tonnes)

3. Italy (2,452 tonnes)

4. France (2,436 tonnes)

5. Russia (2,332 tonnes)

6. China (2,192 tonnes)

Cambodia’s Gold Reserve: Approx. 12 tonnes (small but growing).

Important Note:

· Historically, gold rises in crises. But with prices historically high, future corrections are possible. Caution is advised.

2024–2025 Asset Performance Updates (Cambodia Focus)

Insight:

Asset prices (esp. real estate and agricultural exports) show resilience, while the stock market remains volatile.

Deeper Strategic Analysis: Why Tariffs Are Being Used

Deeper Purposes Behind the New Tariffs

Insight:

Tariffs today are less about economics and more about

bargaining power, geopolitical control, and domestic political positioning. The short-term pain is seen as an acceptable price for long-term strategic gains.

Chairman Xi Jinping’s Southeast Asia Tour: Building Future Alliances

Countries Visited (April 2025): Cambodia, Malaysia, Vietnam.

Purpose:

· Reinforce diplomatic and trade ties.

· Offer alternative trade and investment partnerships.

· Strengthen China’s influence in Southeast Asia amid U.S. tariff pressures.

Implication:

Xi’s outreach signals that China intends to remain a pivotal economic growth driver for Southeast Asia. Countries like Cambodia, Malaysia, and Vietnam will benefit from deeper Chinese investment and strategic cooperation.

Future Outlook: Free Trade and Strategic Shifts

The Challenge to Free Trade

· Rising global protectionism through tariff wars

· Fragmentation and regionalization of supply chains

· Uncertainty in multilateral trade commitments

“China+1” or “China+Many” Strategy

· Companies are no longer just diversifying away from China, but spreading operations across multiple countries to reduce risk.

· Southeast Asia—especially Vietnam, Cambodia, and Indonesia—is central to this diversification model.

Example:

A company may retain R&D and precision manufacturing in China, while moving labor-intensive assembly to Cambodia, and sourcing raw materials from Vietnam or India.

Global Institutional Forecasts (as of April 2025)

Cambodia’s Competitive Edge (2025)

Cambodia is no longer just a low-cost alternative — it’s emerging as a strategic base for international manufacturers and investors. Beyond low wages and land prices, the country offers a favorable blend of policy, geography, and stability.

Key Advantages

· Extensive Trade Agreements:

FTAs with China, Japan, Korea, the EU, and all ASEAN members.

· Strong Government Support:

Promotion of Special Economic Zones (SEZs) and active FDI encouragement.

· Tax Incentives for Foreign Investors:

Up to 9 years of tax exemption under the Qualified Investment Project (QIP) program.

· China’s Belt and Road Ally:

Cambodia is a core partner in China’s infrastructure and trade expansion strategy.

· Robust Infrastructure Investment:

Heavy development in highways, ports, railways, and power grid.

· Political Stability:

One of the more stable environments in mainland Southeast Asia.

· Currency & FX Stability:

Widely uses the U.S. dollar; minimal currency risk for foreign investors.

· Cultural Openness:

High tolerance for foreign languages, cultures, and business styles.

· Strategic Location:

Positioned at the heart of the Mekong region — a gateway between Thailand, Vietnam, and Southern China.

· Early-Stage Market with High Upside:

Low saturation across multiple sectors including land, labor, and capital markets.

Final Strategic Conclusions (2025)

1. The global manufacturing shift toward Southeast Asia is no longer a theory — it’s underway.

Cambodia stands to benefit significantly, especially in textiles, footwear, agro-processing, and entry-level electronics.

2. Labor-intensive and agro-linked industries will anchor Cambodia’s growth in the next 5 years.

These sectors offer the fastest time-to-market, cost advantages, and available infrastructure.

3. Cambodia’s asset classes — especially industrial land, logistics, and agriculture — are positioned for long-term upside.

Fixed asset investment (FDI) is already accelerating.

4. Gold remains a reliable strategic hedge, but investors must be cautious of volatility at record-high prices.

5. Tariffs are reshaping global supply chains.

Cambodia must align itself not just as a low-cost destination, but as a trusted, compliant, and logistically viable hub.

6. China’s continued engagement with Southeast Asia — seen in recent visits to Cambodia, Vietnam, and Malaysia — reinforces the region’s importance.

Expect enhanced infrastructure, capital flows, and integration with China’s evolving trade routes.

7. Cambodia’s competitive advantages are no longer theoretical — they are actionable.

The country is trade-connected, politically stable, and infrastructure-focused, offering a rare combination of low base and high trajectory.

✅ Actionable Outlook:

Investors, manufacturers, and regional planners should monitor Cambodia not as a “backup option” — but as a frontline strategic hub in the next global supply chain era.

Sources: Nation Thailand, Fibre2Fashion, AP News, World Gold Council, IMF, World Bank, UNCTAD, GlobalPropertyGuide, CEIC Data, Cambodia Investment Review, Reuters, SocialistChina.org, Washington Post.