As one of the fastest-growing countries in the region, Cambodia is attracting an increasing number of businesses, viewing it as an important starting point for expanding into overseas markets. Whether in attracting foreign investment or driving industrial relocation, Cambodia is rapidly becoming a key gateway connecting Southeast Asia with the global market.

With the shift of the global economic focus and the transformation of global supply chains, Southeast Asia is becoming a popular choice for global investors. As one of the fastest-growing regions in the world, Southeast Asia is attracting an increasing number of businesses due to its unique geographical advantages, large population dividend, investment-friendly policies, and active regional economic cooperation, making it an ideal destination for expanding into overseas markets.

As one of the fastest-growing economies in Southeast Asia, Cambodia, with its strategic location serving as a gateway to the ASEAN market, highly open foreign investment policies, friendly investment environment, and rapidly developing infrastructure, is becoming one of the top choices for industrial relocation to Southeast Asia. More and more companies are focusing on Cambodia, viewing it as a key starting point in their global and Southeast Asia strategic layouts. With Cambodia as the foundation, businesses are expanding across the entire Southeast Asian market. Cambodia is rapidly becoming the gateway to Southeast Asia!

Ⅰ.Strategic Geographical Location, Connecting to the ASEAN Market

Cambodia is located at the heart of Southeast Asia, neighboring Vietnam, Thailand, and Laos, which provides it with a strategic advantage to connect with the entire ASEAN market and link to the global market.

In terms of regional connectivity, Cambodia lies in the core area of the Greater Mekong Subregion (GMS), allowing it to leverage cross-border economic cooperation and regional infrastructure and economic corridors to link with surrounding countries. As for its reach into the ASEAN market, Cambodia, as an ASEAN member and a signatory of the RCEP agreement, benefits from preferential policies for goods, services, and investment within the ASEAN region, making it an important stepping stone for businesses entering the ASEAN market.

Although the latest 2024 census data shows Cambodia's total population is only 17.28 million, the total population of the ASEAN region reaches 680 million, accounting for approximately 9% of the global population, ranking third in the world, which is about half of China’s population. Such vast market potential is attracting an increasing number of businesses to establish operations in Cambodia, thus positioning themselves in the entire ASEAN market.

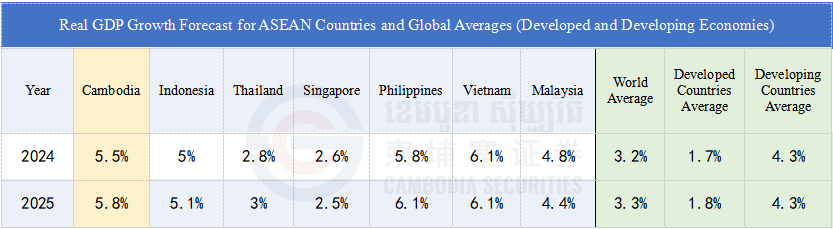

According to the latest forecast released by the IMF in 2024, the projected real GDP growth rate of ASEAN countries in 2024 is expected to outperform both developed and developing countries. ASEAN will continue to be a key engine for global economic growth in the future.

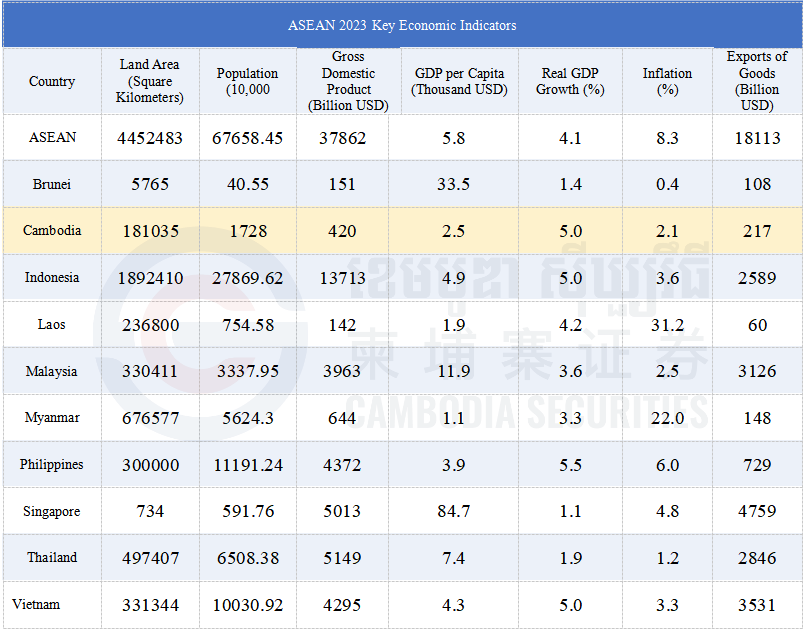

According to data from Euromonitor, the GDP of ASEAN reached $3.8 trillion in 2023, ranking fifth globally. From 2015 to 2023, the nominal GDP compound annual growth rate (CAGR) in USD terms averaged 5.2%, placing it just behind China and India among the top 10 economies. This growth rate is higher than the world average of 4.3%.

Data Source:ASEAN Secretariat and ASEAN 10+3 Macroeconomic Research Office

In addition, Cambodia, as an important participant in China's Belt and Road Initiative, is gradually becoming a key link in the global supply chain, connecting Central Asia, Southeast Asia, and beyond.

In recent years, Cambodia has consistently maintained its leading position in Southeast Asia in terms of economic growth. With continuous improvements in infrastructure, steady inflow of foreign investment, and rapid development in manufacturing and services, Cambodia is gradually becoming an important player in the regional economy. At the same time, Cambodia's economic growth is providing an increasing number of business opportunities for global investors, showcasing its vast market potential and investment value.

Especially in the context of the global supply chain's diversification and decentralization, Cambodia, as an emerging manufacturing hub, offers an ideal platform for businesses to explore new markets and optimize regional production networks. Investors can fully leverage Cambodia's lower operational costs and policy advantages to build a supply chain hub that connects China, ASEAN, and other major global economies, achieving cross-regional resource integration and market expansion.

Ⅱ.Highly Open Foreign Investment Policies, Continuously Increasing Cambodia's Appeal to Foreign Investment

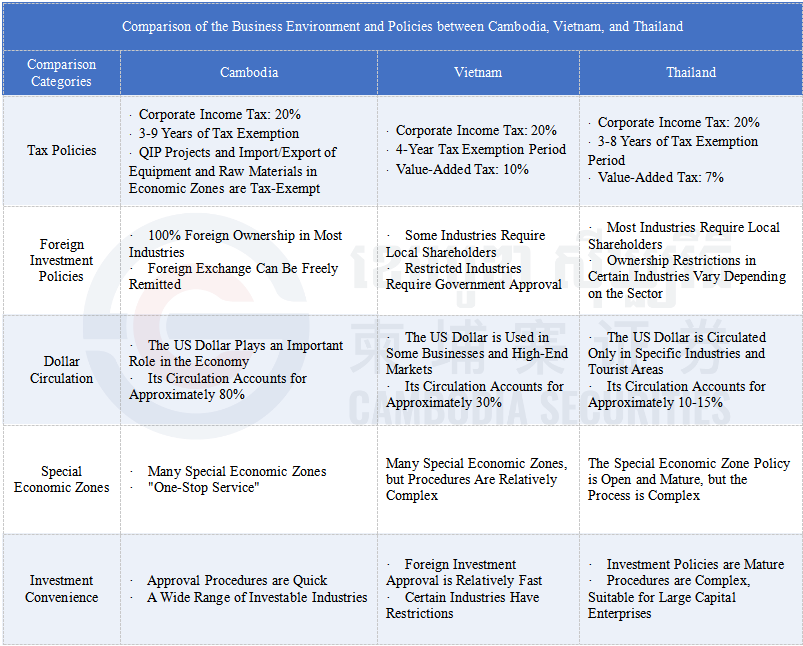

The Cambodian government has consistently adopted a highly welcoming attitude toward foreign investors and has enacted a series of policies to protect their interests. Compared to neighboring countries, Cambodia’s flexible foreign ownership laws and highly open foreign investment policies are making it increasingly attractive to international investors, especially those in labor-intensive manufacturing, startups, and businesses that prioritize policy convenience.

Cambodia widely uses the US dollar for settlement and implements an open foreign investment policy and free foreign exchange policy. This allows businesses' profits, capital, and dividends to be freely remitted, providing investors with a more convenient cross-border transaction environment, effectively improving liquidity and reducing exchange rate risks. This stands in stark contrast to the policies in Vietnam and Thailand, where there are more restrictions on capital flow and foreign ownership.

Cambodia's stable policy advantages are increasingly significant and show great attraction. According to a report published by the National Bank of Cambodia (NBC), from 2018 to 2023, Cambodia's foreign direct investment (FDI) reached $48.4 billion.

Ⅲ. Low Operating Costs and the Dividend of a Young Population, Offering Great Economic Potential

Data shows that the total population of the ASEAN region exceeds 670 million, with over 60% of the population under the age of 35. This large population size and youthful demographic structure provide ASEAN with strong consumer potential and a labor advantage.

According to the preliminary results of Cambodia's 2024 population census, the country's total population is 17.28 million, with about 60% of the population under the age of 35. The labor force participation rate is approximately 80%, which provides Cambodia with ample labor resources and is a key factor driving domestic consumption and economic growth.

According to Euromonitor, in 2023, ASEAN residents' consumption reached $2.1 trillion, accounting for about 4% of the global total, ranking sixth in the world, just behind the United States, China, Japan, Germany, and India.

Based on a series of data, the ASEAN region is becoming a global alternative production base and an important consumer market center. As a member of ASEAN, Cambodia not only has unique advantages in terms of location and policies but also offers significant appeal to investors due to its low-cost operating environment and the strong consumption power brought by its young population.

Compared to neighboring countries such as Thailand and Vietnam, Cambodia has significant advantages in terms of young labor, land, and other operational costs. Its costs are much lower than those of the two countries, making Cambodia an ideal choice for foreign-invested enterprises seeking low-cost operations.

Data Source:Time Doctor

In 2023, the price increase for industrial land in Cambodia was relatively moderate, mainly due to the country's adequate land supply and the industrial parks that are still in the development phase. Particularly in areas surrounding Phnom Penh and in Sihanoukville, investors can still find land resources at lower costs.

In contrast, industrial land prices in Vietnam and Thailand saw more significant increases. Vietnam benefited from a large inflow of foreign direct investment (FDI), with industrial land costs in the northern regions such as Hanoi, Hai Phong, Bac Ninh, Hai Duong, and Hung Yen rising by 7.8% year-on-year to $133 per square meter. In southern regions like Ho Chi Minh City, Binh Duong, Dong Nai, and Long An, industrial land costs rose by 2.4%, reaching $189 per square meter. Thailand, driven by policies such as the Eastern Economic Corridor (EEC), saw continued price increases due to its highly developed infrastructure, with some areas seeing increases of over 6%.

Overall, Cambodia, with its lower land and labor costs, is increasingly attracting the attention of investors. These advantages are making Cambodia an increasingly attractive investment destination and a key gateway to the Southeast Asian market amid the global supply chain transformation.

Ⅳ. Multiple Trade Agreements Bring Tariff Benefits, Boosting Cambodia's Foreign Trade Expansion

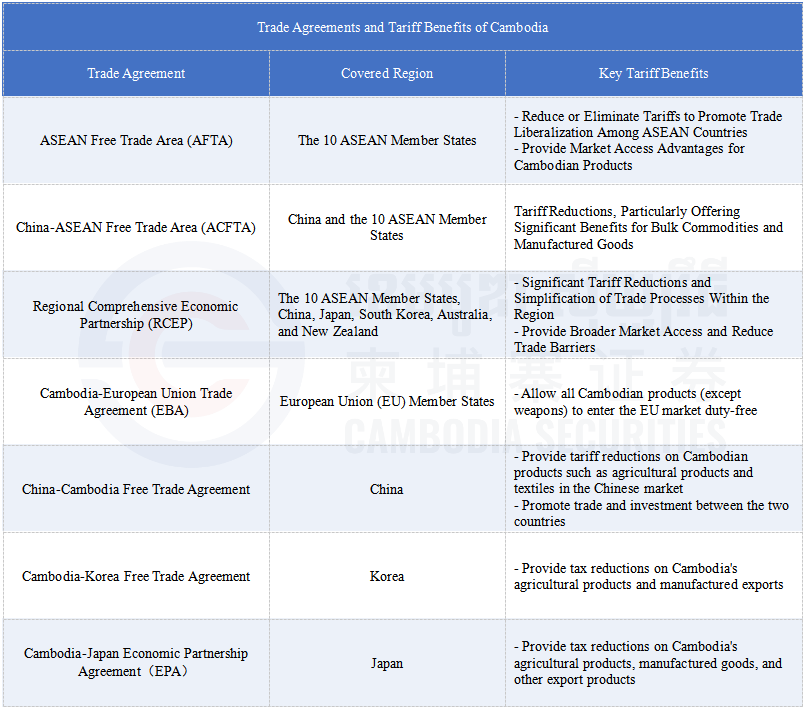

The Cambodian government actively signs trade agreements with various countries and regions, obtaining significant tariff benefits. This has provided strong support to Cambodia's competitiveness in the international market, allowing the country to better integrate into the ASEAN market and global supply chains, expanding international trade and investment opportunities.

Against the backdrop of global economic integration, Cambodia is gradually becoming an important economic and trade hub in Southeast Asia, leveraging the advantages of trade agreements.

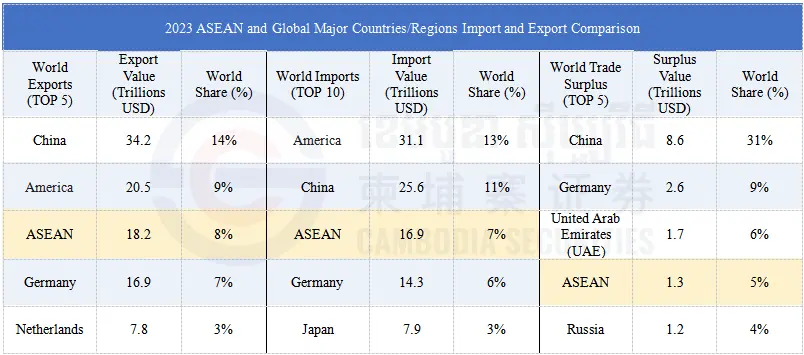

Data shows that ASEAN's total import and export volume ranks third in the world, with a trade surplus ranking fourth globally. From a trade structure perspective, ASEAN's surplus mainly comes from electromechanical equipment, textiles, and agricultural products, while its deficit mainly comes from ores, energy, chemical products, and metals. In terms of trade partners, apart from intra-ASEAN trade, the top three export destinations are China, the United States, and Japan; the top three import sources are China, the United States, and South Korea.

Through trade agreements with major economies and regions, Cambodia has made significant progress in reducing trade barriers and expanding market access. According to data released by Cambodia's General Department of Customs and Excise, the country's international trade volume continues to grow.

In the first nine months of 2024, Cambodia's international trade volume reached $40.94 billion, a 16.4% year-on-year increase. Exports amounted to $19.83 billion, growing by 17%, while imports totaled $21.11 billion, a 15.9% increase.

Cambodia's trade with China reached $11.15 billion, up 22.5%. Cambodia's exports to China totaled $1.28 billion, increasing by 20.8%, and imports from China amounted to $9.87 billion, growing by 22.7%. China remains Cambodia's largest trading partner.

The United States is Cambodia's second-largest trading partner, with bilateral trade reaching $7.8 billion, up 10.2%. Cambodia's exports to the U.S. totaled $7.61 billion, growing by 10.3%, while imports from the U.S. were $190 million, increasing by 6.7%.

Other key trade partners for Cambodia include Vietnam, Thailand, Japan, Canada, and Spain, as well as other important international markets. As cross-border infrastructure continues to improve, Cambodia's position in the global supply chain is gradually increasing.

Ⅴ. Infrastructure and Industrial Upgrades, More Closely Connecting the ASEAN Market

The Cambodian Ministry of Public Works and Transport released the "2024 Mid-Year Progress Report," which mentions that the focus of Cambodia's railway development strategy is to upgrade the existing tracks to high-speed rail and develop new rail lines. A total of eight railway projects are planned, with a total investment of approximately $10.01 billion.

On November 25, 2024, the Cambodian government officially commissioned China Road and Bridge Corporation (CRBC) to study the feasibility of the Phnom Penh-Bavet high-speed rail line. This project will connect Phnom Penh with Kampong Cham, Siem Reap, and Banteay Meanchey provinces, significantly improving Cambodia's transportation efficiency and boosting trade between Cambodia and Thailand.

This railway will also become a key component of the Southeast Asian section of the Trans-Asian Railway project, connecting Cambodia's railway system with Thailand, positioning Cambodia as an important transport hub between Southeast Asia and China.

Additionally, a highway connecting Phnom Penh to the border city of Ba Vieu in Vietnam is also under construction.

Overall, to effectively enhance the efficiency and cost-effectiveness of Cambodia’s land transportation system, the Cambodian government has launched comprehensive infrastructure development.

Techo International Airport, with a designed capacity of 50 million passengers, marks a significant leap in Cambodia's aviation transport capacity. This will pave the way for Cambodia to become a world-class aviation hub and strengthen its connectivity with the global network.

As part of Cambodia's new economic arteries, the Techo Funan Canal, once completed, will link Phnom Penh Port with the port of Baima, enabling seamless river-sea-land multimodal transport. This will change Cambodia's long-standing dependence on Vietnamese seaports and enhance Cambodia's trade efficiency by reducing transit stages and fostering connections with global trade partners.

Cambodia’s infrastructure is undergoing a leap in development, with several large-scale infrastructure projects being initiated and gradually completed. These projects are not only enhancing Cambodia’s transportation network but also laying a solid foundation for the country’s future economic development. With the continuous improvement of Cambodia's sea, land, and air infrastructure, the country will play a more significant role in the process of regional economic integration, providing more opportunities for both domestic and international investors.

In conclusion, with its favorable geographical location, open business environment, and solid policy support, Cambodia has become the preferred destination for many companies entering Southeast Asia and global markets. As Southeast Asia's economy continues to grow and regional integration deepens, Cambodia, as the gateway to Southeast Asia, will play an increasingly important role in the global industrial and supply chains. For businesses aiming for success in international markets, choosing Cambodia as a base is undoubtedly a strategic decision to secure future competitiveness. By establishing a presence in Cambodia and focusing on Southeast Asia, businesses will be able to fully leverage regional advantages, seize global growth opportunities, and open up broader market prospects.

As a comprehensive securities firm, the Cambodia Securities Plc., is committed to providing comprehensive services for businesses, helping them establish operations in Cambodia and standardize the listing process. From the initial establishment of the company to preparing for the listing, we offer professional guidance and consulting to ensure compliance with regulatory requirements. At the same time, we assist businesses in developing future financing plans, supporting them in achieving sustainable growth in Cambodia's capital market.

About Cambodia Securities Plc.

Cambodia Securities Plc., is the first fully licensed securities underwriting firm in the Kingdom of Cambodia to focused on investment banking as its main business since the reform and opening of the securities exchange. The company has obtained significant business licenses in the securities sector issued by Securities and Exchange Regulator of Cambodia (SERC), including underwriting, dealing, brokerage and investment advisory services in the securities sector and other similar financial businesses. which makes this company the first securities company in Cambodia capable of providing services to investors both buyers and sellers.

Cambodia Securities Plc., offers clients a range of services, including pre-listing guidance, mergers and acquisitions, financial advices, corporate consulting, corporate governance systems, and underwriting services to assist issuers in raising funds through public offering of equity securities or bonds. The company also provides a research team to facilitate the application for investors identification and trading account as well.

In addition, the company provides useful services such as brokerage services for stock market trading, investment advisory services and including underwriting guidance. It also facilitates collective investment plans, offering funding, Pre-IPO investments and real estate, while establishing connections with local and overseas partners with extensive business experience.

As one of the main promoters of Cambodia's capital market, Cambodia Securities Plc., will effort to promote the development of the capital market with the support of the government, our company also organized the Cambodia First Capital Market Summit Forum. This professional forum will draw the attention of international investors to Cambodia while also assisting local businesses in raising funds effectively.