In January 2025, Cambodia’s economy demonstrated a positive growth trajectory despite global economic fluctuations and domestic challenges such as underdeveloped infrastructure and a varying labor force skill level. In the short term, rapid growth in industry, services, and agriculture continues to drive economic expansion. Looking ahead, the digital economy and regional cooperation are unlocking new opportunities, while the government is actively implementing measures to promote economic diversification and industrial upgrading.

To provide a comprehensive insight into Cambodia’s economic trends and future outlook, Cambodia Securities Plc.’s latest research report reviews and analyzes the economic developments of 2024 and January 2025.

Cambodia’s 2024 Economic Review

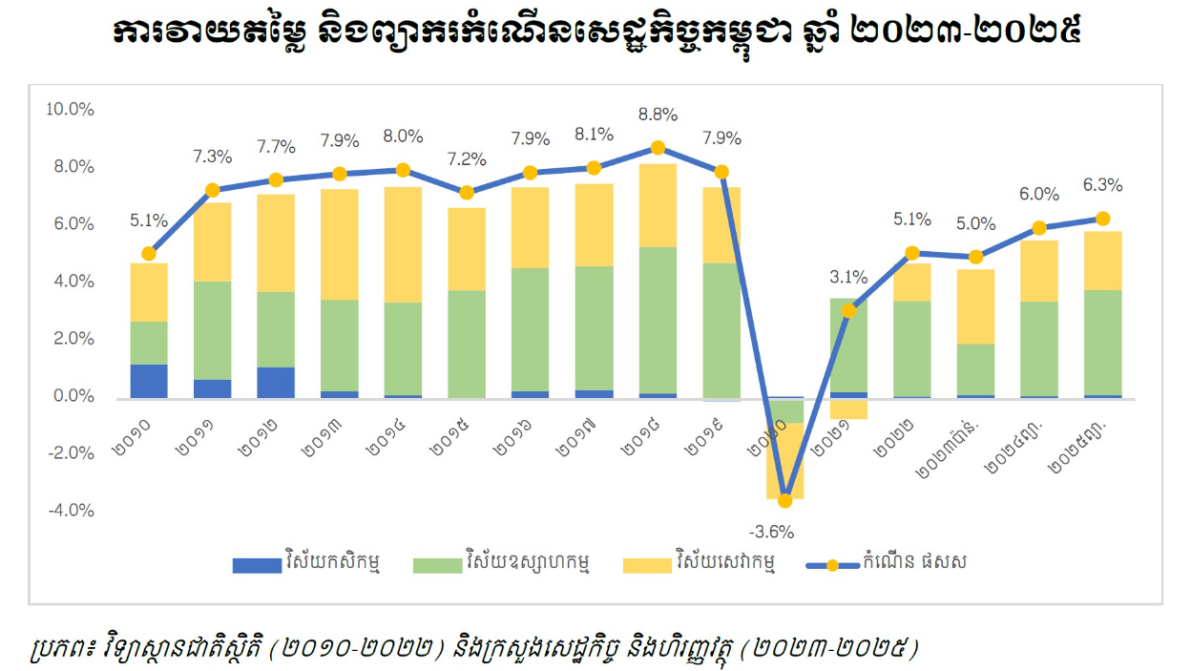

GDP Growth in 2024:Cambodia's GDP growth rate in 2024 is expected to be 5.3%, an increase from 5.2% in 2023. This growth is particularly remarkable given the global economic slowdown. Over the long term, Cambodia has maintained an average annual growth rate of around 6% since 2010, demonstrating strong resilience and growth potential. Key drivers behind this stable expansion include industrial optimization, trade expansion, increased foreign investment, and the recovery of the tourism sector.

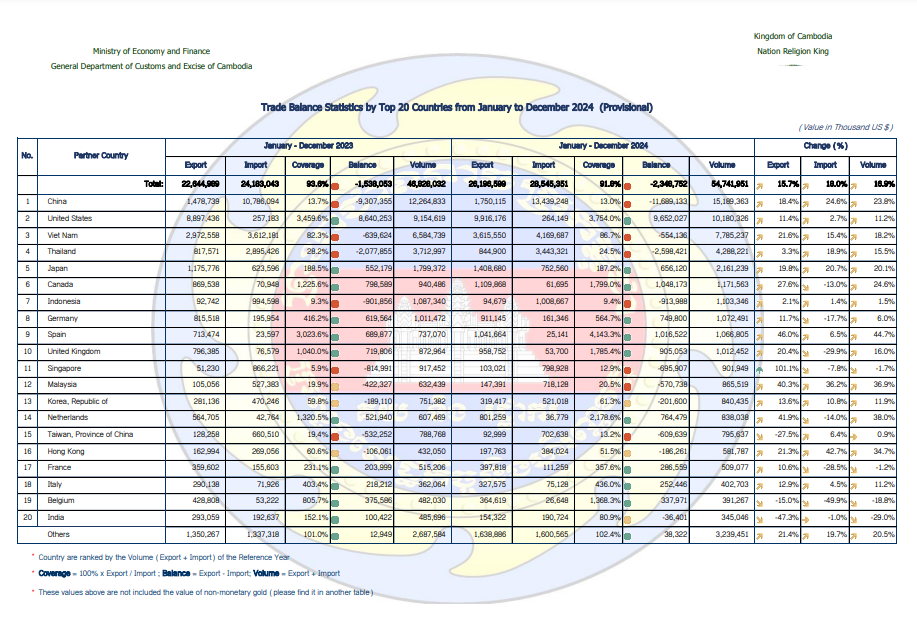

Trade Performance in 2024:Cambodia's international trade volume reached US$54.74 billion, a year-on-year increase of 16.9%. Exports were US$26.19 billion, a year-on-year increase of 15.7%; imports were US$28.78 billion, a year-on-year increase of 17%. Although the trade deficit was US$2.82 billion, which was larger than that in 2023, the overall trade volume increased, indicating that the international market still has strong demand for Cambodian goods.

Key Trade Partners in 2024:The trade volume between China and Cambodia reached US$15.189 billion, accounting for 27.7% of Cambodia's total trade. Cambodia mainly exports agricultural products, clothing, footwear and other commodities to China, and imports machinery and equipment, electronic products, construction materials, etc. from China.

The United States is Cambodia's second largest trading partner, with a bilateral trade volume of US$10.18 billion in 2024, and the main export commodities are clothing, footwear, travel goods, etc.

Vietnam is Cambodia's third-largest trading partner, with a bilateral trade volume of 7.78 billion USD in 2024, mainly involving agricultural products, clothing, electronics, and other sectors.

Sectoral Contributions to GDP in 2024: Cambodia's industrial structure will continue to show a diversified development trend. From the perspective of the proportion of various industries in GDP, the service industry accounts for 42%; the industry accounts for 35%, of which the manufacturing industry occupies a dominant position. In addition to traditional industries such as clothing and footwear, emerging manufacturing industries such as automobile assembly, food and beverage production also maintain strong growth momentum; agriculture accounts for 23%, and the main export agricultural products include rubber, rice, corn, cassava, mangoes and bananas.

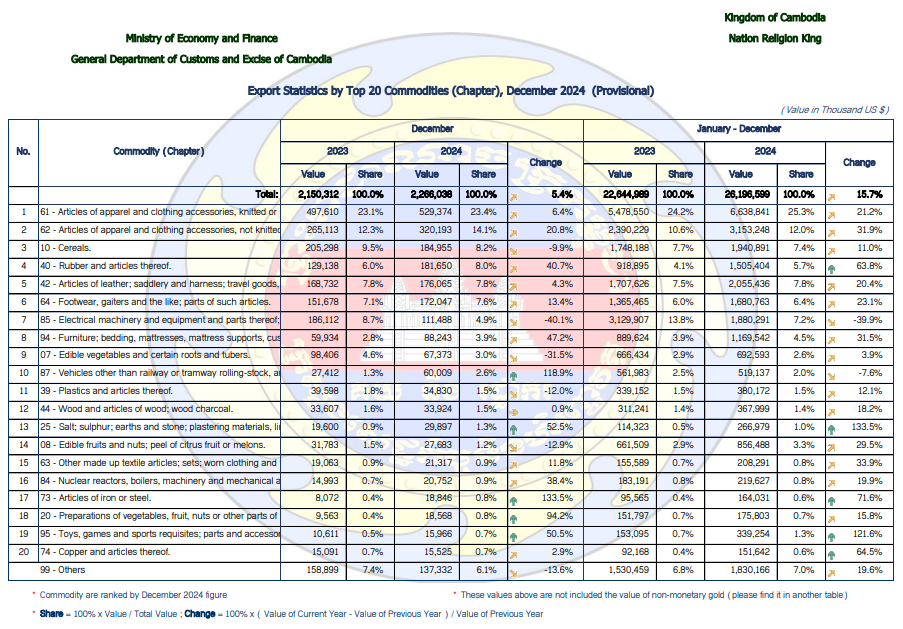

Trade Composition in 2024: Cambodia’s main export products included garments, machinery, electronics, footwear, leather goods, agricultural products, furniture, rubber, fruits, and vegetables.

Among them, clothing and footwear exports still dominate. In 2024, clothing exports reached US$11.66 billion, accounting for 46.2% of total exports; footwear exports were US$3.5 billion, accounting for 13.5%. Agricultural product exports were US$4.8 billion, up 20% year-on-year. Major imports include medicines, health products, food and beverages, electrical and electronic equipment, building materials, agricultural machinery and vehicles.

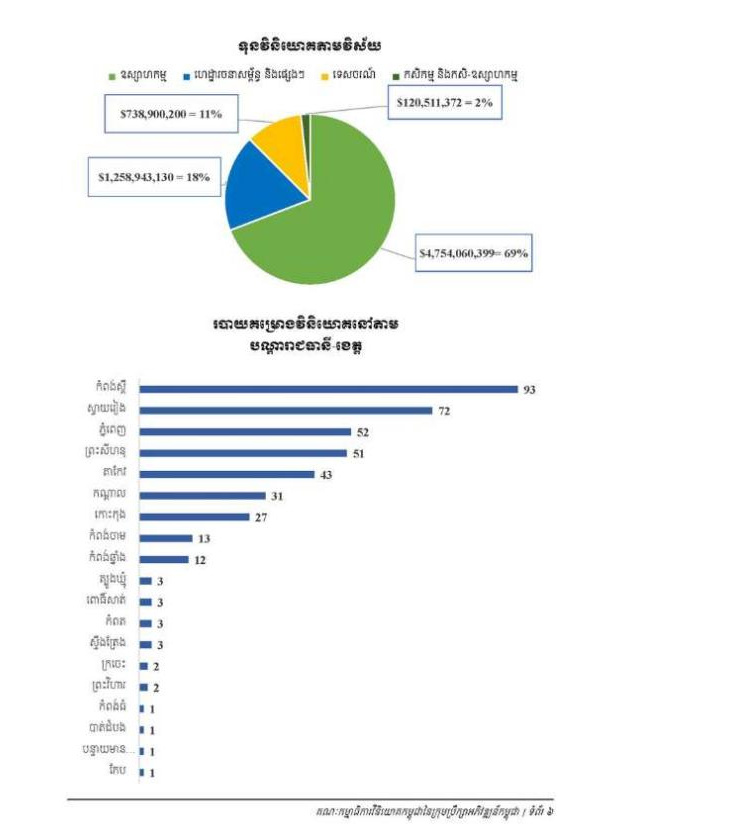

Foreign Direct Investment (FDI) in 2024: Cambodia attracted $6.9 billion in FDI in 2024, a 20% year-on-year increase, marking a historic high. This surge highlights strong investor confidence in Cambodia’s economic potential and business environment.

From the perspective of investment source countries, China is the largest source of foreign investment in Cambodia, accounting for 49.8% of the total investment in 2024, with an investment of US$3.43 billion, covering manufacturing, infrastructure construction, real estate, agriculture and other fields; Cambodian local enterprises ranked second, accounting for 33.8% of the total investment; Vietnam ranked third. In addition, South Korea, Japan, Singapore, Japan, Malaysia, Thailand, Canada, the United Kingdom and other countries are also important sources of investment in Cambodia.

The industrial sector is the field that attracts the most FDI, with a total of 394 projects, accounting for 95% of the investment projects, and the agreed investment amount is about US$4.8 billion, accounting for 69% of the investment amount. Electronics, auto parts, food processing and other industries have attracted a large amount of foreign investment.

There are 8 projects in the agricultural and agro-industrial sectors with an investment of US$121 million; 4 projects in the tourism sector with an investment of approximately US$738 million; and 8 projects in infrastructure and other sectors with an investment of US$1.3 billion.

Performance of Cambodia’s Financial Market in 2024:By the end of 2024, the number of listed companies on the Cambodia Securities Exchange (CSX) reached 23, with the average daily trading value decreasing to $130,000. The total market capitalization fell from $3.17 billion to $2.77 billion.

Cambodia’s 2024 Economic Summary: Despite global challenges, Cambodia demonstrated steady economic growth, with robust international trade, continued industrial diversification, and strong foreign investment inflows. These factors laid a solid foundation for economic growth in 2025, with multiple international organizations expressing optimism about Cambodia’s economic prospects.

Cambodia’s 2025 Economic Outlook & Trends

Multiple organizations have forecasted Cambodia's economic growth rate for 2025 at 5.8%. The International Monetary Fund (IMF), in its January Cambodia Economic Outlook Report, predicted that Cambodia's growth rate will rise from 5.5% in 2024 to 5.8% in 2025, slightly below the Cambodian government’s target of 6.3% for the same period. There are also differences in forecasts from other international institutions, with the World Bank (WB) and Asian Development Bank (ADB) projecting growth rates of 5.5% and 5.8%, respectively, for 2025.

From an industry perspective, Cambodia's economic growth in 2025 will be driven by several key factors: the expansion of manufacturing sectors such as electronics, automotive parts, and food processing, large-scale government investments in infrastructure such as highways, airports, and ports, the recovery of the tourism sector, and the rapid rise of the digital economy, including fintech and e-commerce.

According to the Ministry of Economy and Finance 2025 Budget Brief Report, the industrial sector is expected to grow by 8.6% in 2025, particularly driven by the garment manufacturing and electronics manufacturing industries.

The services sector is forecasted to grow by 5.6%, with the recovery of industries like hotels, restaurants, and other support services being the main growth drivers.

The agriculture sector is projected to grow by 1.1%, with strong performance in crop production and livestock providing support to agricultural growth. Agricultural modernization and increased agricultural exports will further drive the development of Cambodia's agriculture.

Cambodia’s Economic Data & Analysis – January 2025

Foreign Direct Investment (FDI) in January 2025:According to the Council for the Development of Cambodia (CDC), Cambodia attracted $748 million in fixed asset investments in January 2025, marking a 300% year-on-year increase. These investment projects are expected to create 46,000 jobs, signaling strong investor confidence in Cambodia’s economic growth.

Investment Sector Breakdown:Based on investment types, the investments are primarily concentrated in the manufacturing sector—particularly in high-end manufacturing and smart manufacturing projects; renewable energy such as solar energy and wind power projects; infrastructure and digital economy.

These data indicate that Cambodia is rapidly developing towards industrial upgrading and sustainable development. The country is actively promoting a green economic transformation, which also reflects the government’s efforts to improve the business environment and enhance market competitiveness.

Investment Regional Distribution:Investment flows remain concentrated in economically developed regions with strong infrastructure and industrial foundations:

· Kampong Speu Province, Cambodia’s key industrial and logistics hub, attracted 19 investment projects.

· Svay Rieng Province, benefiting from its rich agricultural resources and strategic trade links with Vietnam, secured 13 investment projects.

· Phnom Penh, the country’s commercial and financial center, drew 10 investment projects.

· Sihanoukville (Preah Sihanouk Province), with its special economic zones (SEZs) and deep-sea port, welcomed 9 investment projects.

· Koh Kong Province, leveraging its coastal advantages, saw 8 investment projects in tourism and infrastructure development.

· Takeo Province, driven by growth in agriculture and light industry, received 4 investment projects.

This regional investment trend highlights uneven economic development, with industrialized provinces attracting the majority of investments, while less developed regions continue to face challenges in drawing foreign capital.

Overall, the significant growth in Cambodia's FDI in January has injected fresh momentum into the country’s economic development.

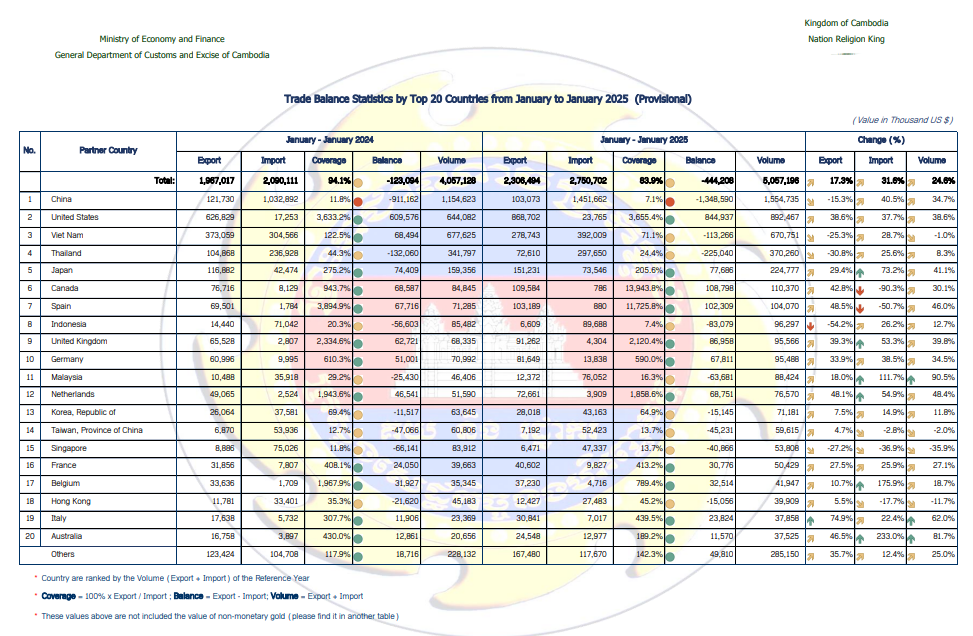

Cambodia’s Trade Data – January 2025:According to the Customs report, Cambodia's international trade in January 2025 reached $5.057 billion, a 24.6% year-on-year increase. Of this, exports amounted to $2.306 billion, a year-on-year increase of 17.3%, and imports totaled $2.75 billion, a year-on-year increase of 31.6%.

Cambodia Trade Partner Data for January 2025:In January 2025, China remained Cambodia’s largest trade partner. The trade volume between Cambodia and China reached $1.55473 billion, a 34.7% year-on-year increase. Of this, Cambodia's exports to China totaled $103 million, a 15.3% down, while imports from China amounted to $1.451 billion, reflecting a 40.5% increase.

The United States remained Cambodia’s second-largest trading partner in January, with bilateral trade reaching $892 million, a 38.6% year-on-year increase. Cambodia's exports to the U.S. totaled $868 million (+38.6% YoY), while imports from the U.S. stood at $23.76 million (+37.7% YoY).

Vietnam ranked as Cambodia’s third-largest trading partner, with $670 million in bilateral trade, marking a 1% YoY decline. Cambodian exports to Vietnam fell sharply to $278 million (-25.3% YoY), while imports from Vietnam grew to $392 million (+28.7% YoY).

Overall, Cambodia’s international trade continued to expand in January 2025, showcasing strong foreign trade momentum. However, imports (+31.6%) grew at a much faster rate than exports (+17.3%), leading to a widening trade deficit. This reflects Cambodia’s heavy reliance on industrial raw materials and consumer goods.

China remains Cambodia’s largest trading partner, but the decline in exports to China highlights the need for further industrial upgrading. Exports to the U.S. saw impressive growth, while trade with Vietnam slowed, with exports dropping significantly.

Going forward, Cambodia may need to optimize its export structure, enhance manufacturing capabilities, and leverage free trade agreements (FTAs) to boost export competitiveness, achieve trade balance, and promote sustainable growth.

Additionally, at the start of 2025, the Cambodian government introduced a series of policy incentives targeting real estate, construction, and finance to attract investment and reduce reliance on low-value-added industries. The country is actively pushing for industrial upgrades and economic diversification, shifting toward high-value manufacturing and the digital economy.

Diversified Growth: Advancing Manufacturing Upgrades and the Digital Economy

Real Estate Tax Incentives:In 2025, the Cambodian government will exempt stamp duty for first-time homebuyers purchasing properties under $210,000. For properties exceeding $210,000, the amount above this threshold can be deducted from the taxable base, and the regular tax rate will apply to the remaining value. Non-first-time buyers can deduct $70,000 from the taxable base. This incentive policy will continue until the end of 2025.

Tax Incentives in the Construction Materials Sector: From 2025 to 2026, the 5% special tax on domestic cement products will be waived for two years.

Securities Market Reforms:The Cambodia Securities Exchange (CSX) has announced that it will improve market mechanisms in 2025, plans to increase the average daily trading value to $300,000, add 15,000 new investment accounts, and attract 6 newly listed companies.

Measures will include margin trading, adjusting the stock price fluctuation limit to 30%, shortening debt settlement periods to T+1, allowing "block trades" to use T+N settlement, and permitting securities to be used as collateral. The CSX will also improve the functionality of its trading platform and make account management more accessible, with plans to introduce the first Exchange-Traded Fund (ETF).

E-Commerce Development Strategy:On January 13, Deputy Prime Minister and Minister of Economy and Finance, H.E. D.r. Aun Pornmoniroth, held a key meeting to formulate the "2025-2028 E-commerce Service Strategy." The plan focuses on using blockchain technology as the core system for public electronic payments, simplifying service processes, and improving transparency and efficiency.

E-Invoicing Pilot Program:On January 22, H.E. D.r. Aun Pornmoniroth, announced the trial launch of Cambodia’s e-invoicing system.

Initially, it will be limited to suppliers of the Ministry of Economy and Finance and the Ministry of Environment.

In conclusion,Cambodia is actively promoting a diversified strategy focused on manufacturing upgrading and the rise of the digital economy. This includes encouraging the development of high-value industries such as electronics manufacturing, automotive components, and renewable energy equipment, supported by tax incentives, infrastructure development, and industrial park construction.

This upgrading trend not only provides foreign enterprises with a low-cost, high-potential production base but also creates investment opportunities related to local supply chain development and export growth.

Furthermore, with the introduction of automation and smart manufacturing technologies, investment demand in sectors such as related equipment manufacturing, skills training, and technical services is growing. Meanwhile, Cambodia’s rapidly growing digital economy offers vast opportunities for investors. The government is heavily promoting the application of e-commerce, fintech, cloud computing, and blockchain applications, as well as improving digital infrastructure, such as the construction of 5G networks development and the upgrading of cross-border payment systems. This has led to explosive growth in industries such as mobile payments, online retail, and smart logistics.

The digitalization of the securities market is creating new entry points for domestic and foreign companies, while business-friendly policies and digital innovation make Cambodia an attractive destination for local and international enterprises.

In conclusion, January 2025 has seen Cambodia make positive strides in investment, trade, and industrial development, with strong performance in sectors such as industry, agriculture, and tourism. However, challenges remain, including insufficient infrastructure, labor market issues, and global economic instability. The government is supporting continuous economic growth through measures like tax incentives, securities market reforms, and e-commerce strategies. Despite these challenges, Cambodia’s economic diversification strategy and proactive policies indicate a strong outlook for future growth.