Dr. Duch Darin, Professor of the Royal School of Administration, recently said that Cambodia's trade and investment may experience a new beginning during Trump's second term.

The China-US trade war may continue to escalate,

and Cambodia is expected to face numerous opportunities

I. The manufacturing industry will significantly shift to Cambodia

If U.S. President-elect Donald Trump fulfils his promise to impose hefty tariffs on China, the China-US trade tensions are likely to persist or even escalate. The US tax policy is often subject to significant adjustments, leading to increased tax pressures and compliance costs for global businesses. As an emerging investment hotspot with relatively low manufacturing costs compared to other Southeast Asian countries, Cambodia is set to seize a tremendous opportunity.

As the impact of the trade war continues to intensify, more labor-intensive and cost-sensitive manufacturing industries, such as apparel, household goods, electronics, electrical appliances, and mechanical parts manufacturing, may shift further from China or other regions severely affected by the trade war to Cambodia. This would drive an increase in Cambodia's manufacturing orders and further expand factory production capacities.

In the new wave of factory relocations, Cambodia is expected to attract the transfer of high-value-added and high-tech industries. Its industrial clusters are likely to expand further, bringing advanced technologies, management experience, and innovative ideas. These factors will drive the modernization and intelligent transformation of Cambodia's traditional industries.

The industrial shift will also create a large number of job opportunities in Cambodia, absorbing labor and increasing household incomes. At the same time, it will stimulate the collaborative development of upstream and downstream industries, such as raw material processing, auxiliary material production, and logistics. This will contribute to accelerated economic growth, optimize the industrial structure, and provide a more diversified range of products for the international market, thus enhancing Cambodia's position in the global manufacturing sector.

II. Cambodia's tax incentives will trigger an investment boom

It is foreseeable that Trump's second term will inevitably bring changes to tariff policies. Global businesses, in an effort to optimize their tax structures and reduce costs, will become more proactive in seeking overseas investment locations offering tax incentives.

Compared to neighboring countries such as Vietnam, Malaysia, and Thailand, Cambodia offers cheaper labor, warehouse leasing, and land costs. It is one of the countries in Asia with relatively low overall business costs. For labor-intensive manufacturing enterprises, Cambodia is one of the optimal choices for controlling costs.

In addition, the Cambodian government offers a tax exemption policy of up to nine years for qualified investment projects (QIP), businesses in special economic zones (SEZs), and enterprises in key development sectors such as innovation and high-tech industries, export-oriented industries, tourism, agriculture, infrastructure, and energy. This makes Cambodia's advantages in attracting manufacturing industries even more prominent and will attract more international manufacturing companies seeking to legally minimize taxes and reduce overall costs to establish operations and build factories in Cambodia.

Furthermore, Cambodia implements an open free-market economic policy with highly liberalized economic activities, no foreign exchange controls, and the free movement of capital. This stable and relaxed investment environment is particularly attractive to companies seeking stable growth and flexible financial operations, especially in a global investment climate that fluctuates due to US policies.

III. Continued strength of the United States dollar will attract more funds to Cambodia

Michael Klein, a senior researcher at Chatham House, mentioned that although Trump himself may hope for a weaker dollar to reduce the US trade deficit, the dollar is likely to appreciate during his tenure.

And the market has recognized the likelihood of a stronger dollar during President Trump's term, the US Dollar Index has risen by about 3% over the past month. According to Huifeng News, by November 22, the Dollar Index had surpassed the 108.00 mark, with a daily increase of 0.93%.

When the US dollar remains strong, international investors are more inclined to allocate funds to Cambodia, which uses the dollar as its currency, in order to minimize the risks associated with exchange rate fluctuations that could affect asset values. Cambodia’s dollar-denominated economy acts as a stable "harbor," where investors do not have to worry about significant asset depreciation due to the local currency devaluation. From the perspective of investor psychology and capital allocation preferences, Cambodia has the fundamental conditions to attract international funds in the context of a strong dollar.

At the same time, a strong dollar also enhances the competitiveness of Cambodia's export products. Products priced in US dollars will have a greater advantage in the international market, attracting more international buyers and stimulating growth in Cambodian exports. This will effectively improve Cambodia's balance of payments, accumulate more foreign exchange reserves, and provide financial support for the introduction of advanced technologies and equipment, thus driving industrial upgrading and creating a positive cycle of industrial and trade development.

IV. The China-Cambodia Free Trade Agreement deepens international cooperation.

Cambodia, located in the core region of Southeast Asia, can play a more active role in cooperation within ASEAN and across the Asian region due to its strong collaboration with China and the demonstration effect of the China-Cambodia Free Trade Agreement (CCFTA).

During Trump's second term, the US may adjust its policies towards Asia, which could prompt countries in the region to reassess and adjust their foreign cooperation strategies. Cambodia can seize this opportunity to strengthen its economic integration with other ASEAN member states and promote cooperation in areas such as cross-border trade facilitation and industrial collaborative development.

Using the China-Cambodia Free Trade Agreement as a model, Cambodia can actively engage in FTA negotiations or establish closer economic and trade partnerships with other major Asian economies like Japan and South Korea, as well as with European countries. For companies in Europe, Japan, and other regions, Cambodia serves as an ideal gateway to enter the Asian market and tap into the potential of emerging markets.

According to the International Monetary Fund's forecast, Cambodia's trade development prospects are very promising. It is expected that by 2025, Cambodia's trade volume will exceed 60 billion USD, and by 2028, it will reach 77 billion USD. This growth projection undoubtedly highlights Cambodia's rise in the global trade market.

From a global market perspective, Cambodia is expanding its trade range by participating in various international economic and trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), making it an important gateway to the ASEAN market. Cambodia has also become a key hub for global companies to establish and expand their businesses in Southeast Asia, helping more enterprises make the leap from regional markets to global markets, and enhancing their position and the position of their partner companies in the global trade landscape.

Historical experience tells us that opportunities and challenges often go hand in hand. From a dialectical perspective, these opportunities can become the driving force for Cambodia's industrial transformation and strong economic growth. Cambodia has close trade ties with both China and the United States, and if trade tensions between China and the U.S. escalate, it could indirectly impact Cambodia's economic development.

Possible challenges for Cambodia

I. Potential challenges in economic and trade relations

The economic relationship between Cambodia and the United States is relatively complex. On one hand, the U.S. is one of Cambodia's important trade partners and one of its largest export markets.

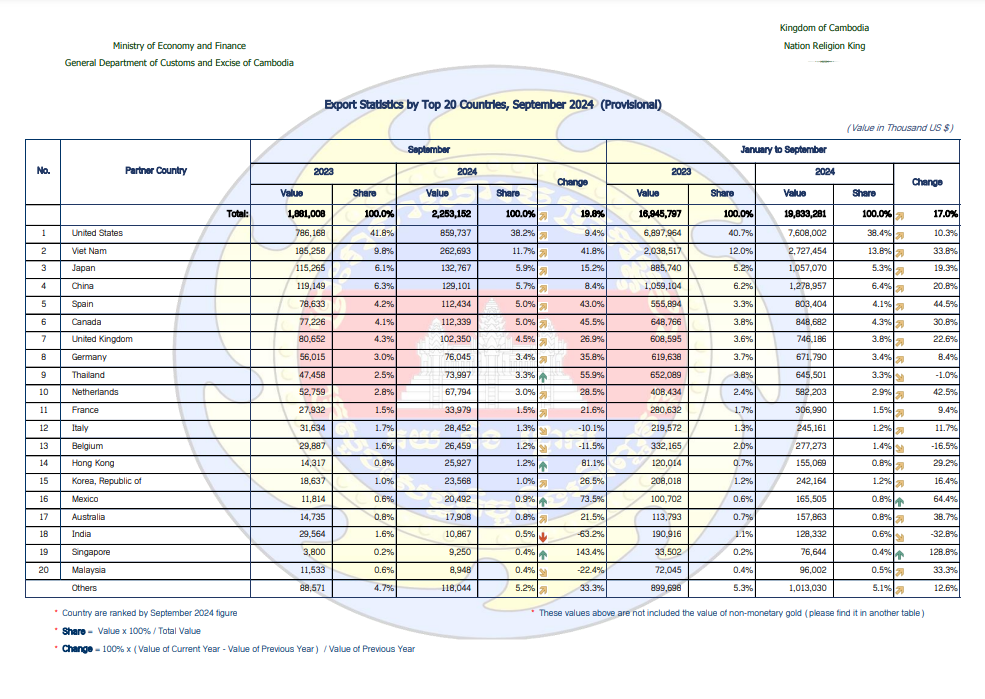

According to the data, in the first nine months of 2024, Cambodia's trade with the United States reached $7.8 billion up 10.2% year-on-year. Of this, Cambodia's exports to the United States reached $7.61 billion up 10.3% year-on-year, while imports from the United States reached $190 million up 6.7%.

On the other hand, the U.S. trade policies and diplomatic stance towards Cambodia are often subject to fluctuations, which brings a certain level of uncertainty to Cambodia's economy.

In 2020, the United States revoked Cambodia's Generalized System of Preferences (GSP) due to serious issues related to labor rights and human rights. During the 2024 election campaign, Trump also stated that, if re-elected, he would impose a 10% tariff on all imported goods. If the U.S. tightens its trade policies toward Cambodia in the future, Cambodia's foreign trade could be impacted. Businesses in multiple industries may face risks such as compressed trade profits, reduced order volumes, and rising costs. This could also affect employment for Cambodian workers and potentially trigger a chain reaction within related industries, thereby impacting the overall stability of Cambodia's economic growth.

II. Businesses and financial institutions may face higher financial risks

After Trump's election, global financial market fluctuations have already occurred. For a country such as Cambodia, which has no strict foreign exchange controls and where the U.S. dollar circulates freely, changes in the exchange rate of the dollar, adjustments in interest rate policies, and fluctuations in investment markets could introduce uncertainty to Cambodia's financial market.

Cambodia may be indirectly affected by U.S. financial policies. Adjustments in U.S. financial policies often alter the global allocation of capital, which in turn can indirectly impact Cambodia's capital flows and changes in its financial markets. As a result, Cambodian businesses and financial institutions could face higher financial risks.

How Cambodia can cope with future uncertainties.

Looking at a series of recent strategies by the Cambodian government, it is clear that Cambodia's economy has developed a certain level of resilience. The Cambodian government is both continuing to strengthen its previously accumulated advantages and flexibly adjusting its response policies to accurately seize every potential development opportunity.

I. Multi-sectoral strategy to promote diversified economic development.

In recent years, the Cambodian government has continuously optimized the industrial structure and promoted the diversification of Cambodia's economy through layout and favorable measures in multiple fields such as industry, agriculture, services and emerging industries.

The government has vigorously introduced and cultivated emerging industries with higher technological content to reduce its dependence on the single industry of the garment industry. As of the first half of 2024, Cambodia has approved 46 special economic zone projects, of which 36 are in operation. These special economic zones play an important role in attracting foreign investors, especially emerging industries.

While ensuring the stable production of major agricultural products, it focuses on the development of agricultural product processing industry, extending the industrial chain and increasing the added value of agricultural products. The service industry is even more multi-pronged. The tourism industry continues to explore characteristic tourism resources and improve service quality. The financial service industry gradually improves the system and innovates business. The logistics service industry accelerates the construction of infrastructure and improves the level of informatization.

II. Strengthening infrastructure development and improving the carrying capacity and level of service of the transport system

In order to better meet the demands of economic development, the Cambodian government has been increasing efforts in infrastructure development in recent years, focusing on transportation, electricity, water supply and irrigation, as well as communication.

At the present stage, the government is actively planning and constructing new transportation networks, including highways, bridges, railways, and airports. It is also collaborating with China and neighboring countries to increase cooperation in stable and reliable clean energy, such as hydropower and solar energy, exploring green, solutions to improve the security and reliability of regional electricity supply.

Additionally, the government continues to invest in expanding communication networks, narrowing the digital divide in rural areas, promoting the development of the digital economy, and strengthening the application of information technology in various fields such as e-government, e-commerce, electronic payments, and smart transportation.

III. Multi-pronged measures to enhance the competitive advantage of the local labour force

In order to meet the demand for human resources for economic development, the Cambodian Government has actively promoted the reform of the education system, increased investment in basic education, and improved school hardware facilities. It has formulated and implemented initiatives to improve the quality of education, strengthened the development of teachers, and focused on cultivating the comprehensive quality and practical ability of students. Vocational training has been strengthened in cooperation with enterprises and institutions, and a series of rich and diverse vocational training program have been launched, and the scope of vocational training has been expanded to rural areas in order to support the growth of local enterprises and ensure the global competitiveness of the local labor force.

IV. Improving the financial system and strengthening financial risk management

At present, the Cambodian Government is constantly improving and developing its financial system, and the number and scale of operations of financial institutions, such as banks and securities institutions, are constantly expanding, and these financial institutions have created diversified financial services for enterprises, which can effectively satisfy their financial needs.

In addition, Cambodia has actively cooperated with the World Bank, the Asian Development Bank and other international financial institutions to carry out a number of projects, and has received a large amount of financial support and technical assistance. At the same time, it actively strengthens cooperation with financial institutions in neighboring countries to promote cross-border financial business with neighboring countries and provide convenient financial services for enterprises' international trade and investment.

Of course, the Cambodian government is also continuously improving the financial regulatory system, establishing sound financial laws and regulations, strengthening coordination and cooperation among financial regulatory agencies, improving regulatory efficiency and forming regulatory synergy.

V. Strengthening regional cooperation to achieve regional connectivity

In recent years, the Cambodian government has actively engaged in international cooperation, participating in various high-level ASEAN meetings, diplomatic activities, and political consultation mechanisms. Cambodia has played a role in building the ASEAN Political-Security Community and has actively participated in infrastructure projects under the Greater Mekong Subregion (GMS) Economic Cooperation, working toward regional connectivity. The country has also responded positively to China’s Belt and Road Initiative, collaborating extensively with China in areas such as infrastructure development, industrial park development, and tourism.

At the same time, Cambodia has strengthened cross-border trade with Thailand, establishing multiple trade ports and economic zones in border areas; it has pursued industrial collaboration with Vietnam, particularly in textiles, garments, and agricultural product processing; and has worked with Laos in the hydropower energy sector, contributing to both countries' economic development and enhancing regional energy security.

The unpredictability of Trump's policies has always been a significant variable in the international economic landscape. The incoherence of his first administration's trade and foreign policies caused difficulties for Cambodia and many other countries in formulating economic development strategies.

However, Cambodia has now paved an effective development path by focusing on developing its own industries and carefully constructing a diversified industrial layout. This has not only allowed the economy to run smoothly but has also significantly enhanced the country’s competitiveness, its ability to withstand external shocks, and its increasing participation in the global value chain. The positive development momentum that Cambodia now demonstrates is a powerful response to a volatile external environment and has laid a solid foundation for the long-term development of its economy.

About Cambodia Securities Plc.

Cambodia Securities Plc., is the first fully licensed securities underwriting firm in the Kingdom of Cambodia to focused on investment banking as its main business since the reform and opening of the securities exchange. The company has obtained significant business licenses in the securities sector issued by Securities and Exchange Regulator of Cambodia (SERC), including underwriting, dealing, brokerage and investment advisory services in the securities sector and other similar financial businesses. Which makes this company the first securities company in Cambodia capable of providing services to investors both buyers and sellers.

Cambodia Securities Plc., offers clients a range of services, including pre-listing guidance, mergers and acquisitions, financial advices, corporate consulting, corporate governance systems, and underwriting services to assist issuers in raising funds through public offering of equity securities or bonds. The company also provides a research team to facilitate the application for investors identification and trading account as well.

In addition, the company provides useful services such as brokerage services for stock market trading, investment advisory services and including underwriting guidance. It also facilitates collective investment plans, offering funding, Pre-IPO investments and real estate, while establishing connections with local and overseas partners with extensive business experience.

As one of the main promoters of Cambodia's capital market, Cambodia Securities Plc., will effort to promote the development of the capital market with the support of the government, our company also organized the Cambodia First Capital Market Summit Forum. This professional forum will draw the attention of international investors to Cambodia while also assisting local businesses in raising funds effectively.

What impact would Donald Trump's re-election have on Cambodia's future economy?